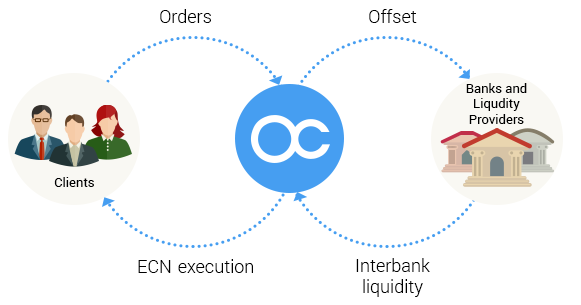

What is ECN/STP trading?

It is a broker's business model (which, generally, makes the difference between brokers and "market makers"), in which clients' orders are sent directly to one or several liquidity providers to be executed on their end. There may be an unlimited number of liquidity providers (that is, banks, aggregators, other financial institutions). The more liquidity providers a broker has, the better the execution for its clients (more liquidity available, less slippage). What makes a true STP broker is that it doesn't internalize the orders, but sends them to liquidity providers, acting as an intermediary between the client and the real market.

Do you have requotes?

No, we don't. Any broker who re-quotes your orders is definitely a dealing desk broker. A requote occurs whenever the dealer on the other side of the trade (whether human or automatic) sets an execution delay during which the price changes. Therefore he can't open your order and sends you a message that the price has changed. That is, a requote. You usually get a new price which can be significantly different from the one you requested (especially when the market is volatile). In most cases it's not profitable for the trader but quite profitable for the broker. OctaFX doesn't have any requotes simply because we don't have a dealing desk, human or automatic (a piece of software usually referred to as a virtual dealer, automatic dealer and so on).

Can I scalp? Do you allow news trading?

Yes, you can. Unlike the majority of brokers out there who either directly prohibit scalping or indirectly prevent scalpers from trading, we welcome scalpers. By this point you are certainly wondering why. Dealing desk brokers hold the other side of your trades. That is, they expect the market to go in the opposite direction and you lose. Scalpers use very short orders, which means they stay in the market for a very short period of time, during which the market doesn't change its course.

The other problem for a dealing desk is that scalpers generate a huge number or requests at the same time (let's say during important news releases) which makes it hard for a dealing desk to handle them.

OctaFX passes all the trades to its liquidity provider and just receives its commission. Therefore we are interested in high volumes (the higher the volume — the higher is our commission we get), which are usually generated by scalpers.

How do I find out if my broker is a dealing desk?

There are a number of rules and regulations usually applied by dealing desks, such as:

- A direct or indirect prohibition of scalping, news trading, other strategies

- Fixed spread

- So-called "guaranteed" stop orders

- A possibility of requotes

If you encounter any of these, your broker most certainly is a dealing desk. Dealing desks (or, so truly referred to as "market makers") in fact create their own markets for you with their own rules (described above). Needless to say these rules do not serve you; they are designed BY their creators and FOR their creators. NDD brokers such as OctaFX act as intermediaries between the trader and the real market, and receive a strictly defined and transparent commission for it.

How do dealing desks earn?

In general, they do not offset your orders anywhere, rather they keep them inside. What you see in the charts is market maker's prices which may resemble the real ones, but in fact they are made up by the broker.

So in this case, if you buy, let's say, EURUSD at a certain price, the broker opens your order, but doesn't offset it, because he assumes EURUSD will go down. If it does, you lose your deposit, and broker takes it. Alternatively, if you win, the broker has to pay you with his own money. Of course any market maker will do everything to prevent you from winning. Whether legal or illegal, anything goes when it's about the money. That's where you will face requotes, spikes and so on.

How does OctaFX make money? OctaFX needs profitable traders? WHY?

OctaFX receives a certain commission from its liquidity providers for each transaction. We add it as a markup to spreads you see in the charts (note that the markup is already included, no matter if you gain or lose).

We receive our liquidity from a wide range of liquidity providers around the world. Our system is designed to offer the best prices available at each moment to the clients. When you open a new order, you get the best available bid (or ask) price directly from liquidity providers with our commission already included. Therefore we are interested in you trading more. And the best way to do so is to gain, not lose. This means we are interested in ensuring that your trading is as profitable as possible.

You have no requotes. WHY?

Putting it simply, we don't requote you because we have nothing to do with the quotes (i.e. the prices you see in your trading software). The order is filled when a price from one of our liquidity providers is available. It is important to understand, however, that we do not guarantee that your order will be filled exactly at the requested price; our system is setup to fill it by the next best price from another liquidity provider. But, again, your order will not be requoted, since we are more interested in your profitable trading.

Can liquidity providers see my orders?

No, they can't. From their point of view they see only one customer, that is, OctaFX. You remain anonymous to them in all cases.

The chart went through my limit, but my order wasn't opened. What's going on?

It is a possible situation and it usually happens due to lack of liquidity at a certain period of time. Let's say a number of clients put sell limit orders prior to important news release with total volume of 1000 lots. When the news is released, it makes the market go up 50+ pips. So the chart hits the price of all these orders and it is requested to open a number of orders worth 1000 lots in total. It may happen that only 200 lots are available at the time from the liquidity providers at this price at this given time. In this case the first 200 lots out of 1000 will be filled, while the rest 800 will not be filled (no available liquidity) and will remain waiting until the price hits their level again.

Do you allow EAs?

Absolutely. Any EAs are welcomed.

Which spread is better, fixed or variable?

Variable is better because it is real. In the interbank market there is no such thing as fixed spread. Whenever a bank or any other financial institution wants to buy or sell currency, it sets the required bid or ask. That is, the price they want at the moment. In the real world the difference between Bid and Ask simply can't be fixed.

So every dealing desk broker offering fixed spreads has to manipulate prices to fix the spread. In most cases these manipulations work against the trader.

Let's say your broker has 2 pips fixed spread on EURUSD. During daytime the spread is usually about 1 or 1.2 pips. That means you lose 0.8 pips in each single trade, and your dealing desk broker is happy.

On the other hand, the very same EURUSD spread can widen to 5-6 pips during important news releases (like NFP). If your broker wants to keep 2 pips fixed spreads, it will either pay 4 pips difference for you or requote you, because it doesn't want to pay. Most probably a requote will happen since the dealing desk doesn't want to lose 4 pips.

What is slippage and why does it happen?

Slippage is a slight order opening price movement which is a result of lack of liquidity (when it's already taken by other traders' orders). It may also happen during market gaps.

It is important to understand that we do not guarantee that your order will be filled exactly at the requested price; our system is setup to fill it with the next best price from another liquidity provider.

So during these news times it's possible that there will be no liquidity available at the price you requested. Let's say you want to open a 5 lot Buy order, EUR/USD, price is 1.30000. Now, in this case we can see the following liquidity available:

- Provider 1: price is 1.30010, 20 lots available

- Provider 2: price is 1.30005, 5 lots available

- Provider 3: price is 1.30000, 1 lot available

In this case your order will be offset with Provider 2, since he has the best price and enough liquidity to fill your order. And the open price will be 1.30050, which is 0.5. pips away from the price you requested. But, again, your order will not be requoted, since we are more interested in your profitable trading.

Why don't you guarantee stop orders?

Again, in the real market there is no such thing as a "guaranteed stop"; it is offered by dealing desks only. As stated above, market makers do not offset your orders anywhere, rather they keep them inside. So when your "guaranteed" stop loss is triggered, it means that your whole loss amount is already in the dealer's pocket.

This causes so-called "stop-loss hunting" practice. The dealing desk can see where your stop orders are, so it's easy for them to manipulate the price, so that it hits your stop-loss.

In real market any stop order is considered as pending until its price is hit. After that the order is offset to a liquidity provider (which, again, may or may not involve slippage depending on the available liquidity). Therefore it's simply impossible to either "guarantee" or "hunt" your stop orders.

No comments:

Post a Comment