Description

Cruscotto is the ultimate currency strength/weakness indicator. It monitors the status of the 8 major currencies, gold and oil in real time, using the data coming from 6 different time frames: from 15 minutes up to one month of data.

This will not only give you an overview of the currency situation, but also the details on its performance in the short term.

The strength/weakness score goes from -100 to 100 and is calculated using all the pairs in which the currency is involved. So for example, when you see a strong EUR and a weak USD, it means that the EUR is strong vs all the other currencies and vice versa for the USD. That makes a long trade on EURUSD much more likely to end profitably.

Analyzing the single currencies, Cruscotto will help you choose the best pairs to trade. Simply take the currency or currencies that are stronger and match with those that are weaker. You can easily view them as the strong ones have green histograms while the weak ones have red histograms.

Also, when the score is more or less of a limit (a sort of signal zone), the label of the period becomes green/red accordingly. This is the signal or at least the first half. Now to be sure, you need another pair that, in the same time frame, gives the opposite signal and you can enter a short/long trade on that pair.

Depending on the time frame, you'll have different targets ranging from a few pips to whatever works best on the time frame you are trading.

It can be that easy.

You can trade with the Cruscotto alone or (even better) integrate it into your trading system to help you in your trading decisions. The strength and weakness of two currencies can easily help you understand the trend of a pair.

From the long term to the short term, remember... the trend is your friend, and the best trends come when there's divergence between two currencies, when one is strong and the other is weak.

The Cruscotto algorithm works by analyzing price only. It doesn't use any other indicators like moving averages, RSIs, etc. So, all the signals are real time and not lagging like other indicators.

You'll also see how currencies are correlated. You'll see what it means to have a strong Yen, a strong US Dollar or a strong Euro.

Having Gold and Oil in Cruscotto will also help those who are not trading them, as there are interesting intermarket correlations that will help you to sometimes "predict" the market.

Cruscotto is one indicator but it comes in three different layouts: Horizontal, Vertical and Squared to fit your setup and your screen resolution.

How to apply it

Open the Metatrader 4 platform where you just installed the Cruscotto indicator.

Due to the sophisticated interface, the indicator is made to stay on dedicated chart windows. We supplied you with 3 templates, one for each of the 3 setups that the Cruscotto indicator can have: squared, vertical and horizontal. It is up to you to use the one that suits you best. That also depends on your screen size. The squared version is compact and works well on all monitor sizes.

First of all, we have to make sure that all the required symbols for the calculation of the currencies' strength/weakness scores are visible in the "Market Watch" window. If you don't have it open, go to the "View" menu, and choose "Market Watch" (or press CTRL+M).

Once the Market Watch window is open, right click on it, and from the menu choose "Show All". This will list ALL the symbols that your broker makes available for trading. You can close the window if you don't need it.

You can now open a chart of a pair (any pair and any timeframe), but try to use one that updates often like EURUSD, GBPUSD, etc.

Now, right click on it and choose "Template". The installer should have added 3 templates:

• Cruscotto_horizontal, for the horizontal setup

• Cruscotto_squared, for the squared setup

• Cruscotto_vertical, for the vertical setup

If you have a screen that is big enough, you can try the horizontal or vertical options.

Here's an example of a screen setup using the vertical template:

And the following is an example of a screen setup using the horizontal template

If you want to use less space, you can disable "Gold" and "Oil" by setting the "commodities" option to FALSE. In the next paragraph, we'll go more in depth on each of the available options.

When you apply the template or simply the indicator to a chart, it may require a little time for the indicator to show. This is due to the fact that the indicator is downloading data for all of the 20 currency pairs used (+2 commodities) for 6 timeframes. This usually takes longer the first time but will be much faster the second time and onwards.

If you don't have one or more of the needed symbols available, the indicator won't show up. What you can do is firstly, set the "commodities" option to FALSE (not all the brokers stream gold and oil). If yours do, make sure that the right symbol name is the related option.

If disabling "commodities" (setting it to FALSE) doesn't show the indicator, it means that any of the 20 currency pairs needed is not available or not listed in the "Market Watch" window. The list of the 20 pairs can be found in the "Prerequisites" section of this manual.

It may also happen that some time frames show a value of 0. This is probably due to a lack of historical data like the example below, in the "monthly" and "weekly" time frames:

Cruscotto Anatomy

The Cruscotto indicator shows you a weakness/strength score for the 8 major currencies:

• AUD - Australian Dollar

• CAD - Canadian Dollar

• CHF - Swiss Franc

• EUR - Euro

• GBP - Pound

• JPY - Japanese Yen

• NZD - New Zealand Dollar

• USD - US Dollar

It is also calculated for gold and oil commodities if their data are streamed by your broker.

The score goes from -100 (weak) to +100 (strong) and is calculated using data of different time ranges (or time frames):

• monthly (43.200 minutes)

• weekly (10.080 minutes)

• daily (1.440 minutes)

• 4 hours (240 minutes)

• hourly (60 minutes)

• 15 minutes

I'm reporting the values in minutes as the indicator uses the 1M time frame to calculate all the others. It is made this way so that the score is perpetual and not resetting at the beginning of a new month, week, day, etc.

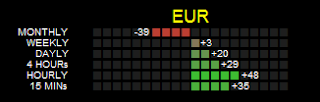

Let's see how the different sections of the 8 currencies (10 including gold and oil) look:

This is for Euro but the same applies to all the other currencies and commodities.

To each line corresponds a time frame from monthly (topmost) to 15 minutes (at the bottom).

For each line, it gives a score going from -100 (weak) to +100 (strong). A colored histogram helps to visually read the values.

How to read it

The more the score gets weaker and much closer to -100, the brighter red it becomes. And vice versa, the more the score gets stronger and much closer to +100, the brighter green it becomes.

In the example, you can see that on the monthly time frame, the score is -39 which is a little weak, but all the following time frames have an increasing value.

What does this mean? The Euro is weak but is getting stronger than it had been before, so it is in a phase of increasing strength. In this case, we'll tend to wait for the Euro to get stronger, and based on our trading style, we should wait for the time frame to become green before preferring to trade long on the Euro.

But, the best results are accomplished when we have a currency pair that has a strong currency and a weak currency within the same time frame.

See the following example:

We have a very strong CHF (Swiss Franc) as all the time frames are above the score of +70 (in BUY zone). And while we have a generally weak CAD (Canadian Dollar) particularly in the 1H time frame, we also have a quickly weakening GBP (British Pound) particularly in the 1H and 15M time frames.

In this situation, what the Cruscotto suggests is for us to trade short on GBPCHF.

We can also see that all the other currencies are almost flat or without clear trend direction.

But let's look at another example:

Here, we have a more interesting situation. Let's analyze all the currencies one by one:

AUD is becoming stronger and stronger so it's very good to be considered for buying (we've got 3 time frames in buy zone).

CAD has been weak but is quickly gaining a lot of strength lately so it's good to be considered for buying (we only have the 15 minute time frame in buy zone, but if it continues that way the longer ones will follow soon).

CHF is very strong especially in the longer time frames but it is also weakening, so I would not buy it until the lower time frames regain strength. But, if you consider that it may be a retracement from a strong trend, it may be a good buy if we expect the long term trend to be bullish.

EUR is regaining in strength but there is no clear signal of a real reversal as of yet.

GBP is generally quite week, almost the same as that of CHF but with less "power". I wouldn't consider it for a short trade until the shorter time frames (15M and/or 1H) enter the sell zone.

JPY has weakened strongly and quickly. So it's a pair that is good for a short trade for the rest of the day.

NZD shows no clear trend here. It seems to be regaining a little strength but is nothing serious for now.

USD is very flat, losing a little ground but is still not good enough for trading.

So we have AUD and CAD at BUY and JPY at SELL. Thus, we have to focus on long trades on AUDJPY and CADJPY.

About the two commodities... we can see that Gold has weakened strongly and quickly (look at the direct correlation with JPY!), while Oil is very strong in all the time frames (another direct intermarket correlation with CAD!).

This is just a quick and simple example of how to read the information coming from the Cruscotto. As written before, you can use it as a "general" guide to choose the best pairs to focus on, aside from your trading system, to filter for the right time to trade or not. Remember that when the Cruscotto tells you that a currency is strong or weak, it is against ALL the other currencies in general and so making the signal far more reliable.

But, you can also trade with it alone. No other indicator needed. Simply wait for one weak currency and one strong currency, pair them up and trade accordingly. Depending on the time frame that the signal is coming from, expect a target that can go from a few pips to much more.

But remember... when you see something like this:

Stay away!

Cruscotto Prerequisites

To run the Cruscotto requires that your broker uses no suffix or postfix with the symbol names.

Also, it requires that the following 20 pairs are streamed by your broker and are visible in the "Market Watch" window.

• AUDCAD

• AUDNZD

• AUDUSD

• AUDJPY

• CADJPY

• CHFJPY

• EURAUD

• EURCAD

• EURCHF

• EURGBP

• EURJPY

• EURUSD

• GBPCHF

• GBPJPY

• GBPUSD

• NZDJPY

• NZDUSD

• USDCAD

• USDCHF

• USDJPY

The presence of those 20 symbols is mandatory.

If your broker streams also feed for Gold and Oil, and you want them shown by the Cruscotto, you need to set the "commodities" at TRUE and put in the related symbol name. So, put the symbol for gold in "gold_symbol" and the symbol for oil in "oil_symbol". The default values are valid for Alpari UK broker, so those applying it on their platform do not need to edit anything.

To be sure that you have fed all the symbols available to the indicator, please follow the instructions in the "How to apply it" section of this manual.

That's all. I really hope that you'll enjoy trading with the Cruscotto alongside, and I'm sure that it'll help improve your trading performance.

Trading Platform: MetaTrader 4

Category: Trading Strategy

Author: Andrea Salvatore

No comments:

Post a Comment